Project KidZ, Inc

Project KidZ EDU EDT. A Non-Traditional Educational Station

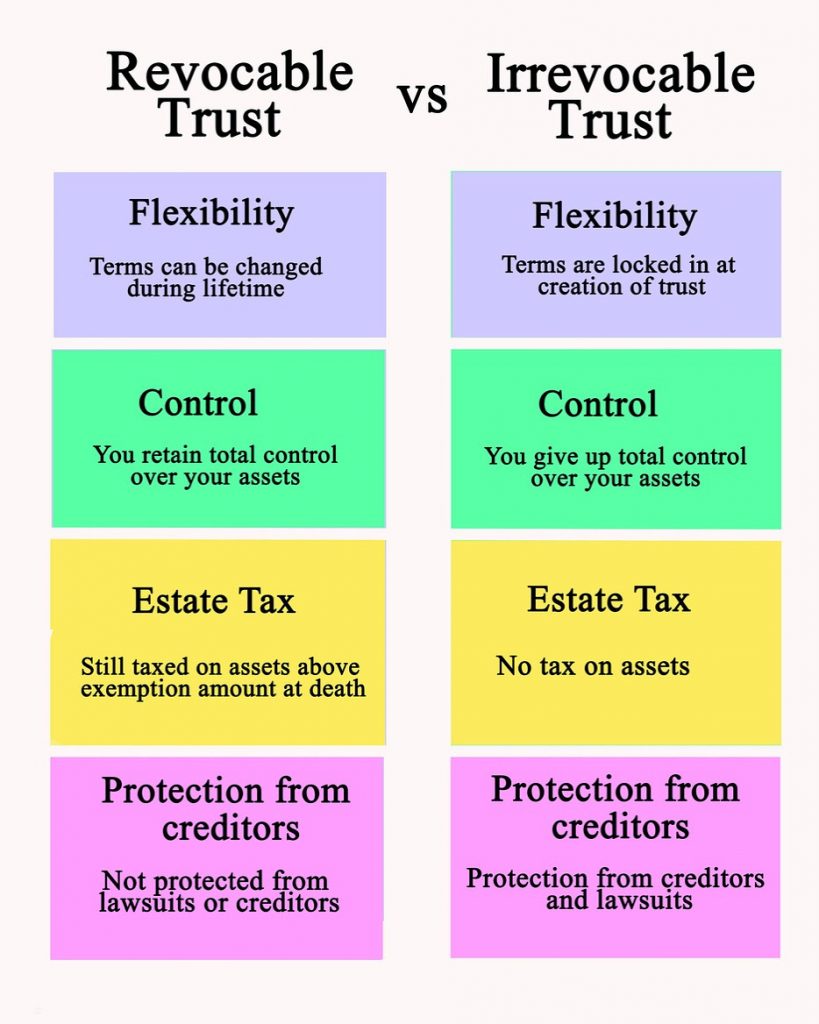

3 Steps to Obtaining your Irrevocable Trust

Contact an Attorney or another Fiduciary

- Prepare the Trust and Legal Documents

Consult Professionals: Work with an estate planning attorney, business attorney, and tax advisor to understand the legal and tax implications.

Create the Trust: Draft a written trust agreement that outlines the terms, names a trustee, and designates beneficiaries.

Obtain a Tax ID: Apply for an Employer Identification Number (EIN) from the IRS for the trust, as it is a separate legal entity. (You would obtain this in the name of your LLC. Also, check to make sure the name chosen is not Trademarked. Search First: Use the USPTO’s Trademark Electronic Search System (TESS) to ensure your mark isn’t already registered or too similar to another mark.

Review Business Agreements: Check your operating or shareholder agreements to confirm they allow ownership transfer. Amend them if necessary, which may require the consent of the partner or the corporation.

- Transfer Business Ownership

Draft Transfer Documents: Prepare an “Assignment of Interest” for an LLC or an “Assignment of Stock” for a corporation to legally transfer ownership to the trust.

Sign and Accept: Sign the assignment as the grantor. The trustee must also sign an acceptance document to assume responsibility on behalf of the trust.

Submit to the Business: For corporations, submit the signed assignment so new stock certificates can be issued to the trust. For LLCs, file any required amendments with the state.

- Complete Post-Transfer Requirements

Notify Authorities: Inform state and tax agencies about the ownership change.

Fund the Trust Account: Open a bank or brokerage account in the trust’s name using its EIN to manage business funds.

Inform Beneficiaries: Communicate the trust’s terms and management details to beneficiaries.

Review Regularly: Periodically update the trust and business agreements to ensure they meet your ongoing needs. You can then begin to transfer all assets accordingly.

How to transfer property to an LLC in 10 steps

Follow these steps to transfer property to LLC business structures.

01. Register Your LLC

File Articles of Organization with your state.

Pay required fees and obtain a Certificate of Good Standing (if needed).

02. Review Documents

Check the property title for transfer eligibility.

Create or update your LLC Operating Agreement (ownership, profit division, sale terms).

03. Prepare a Deed of Transfer

Choose between:

A.01 – Warranty Deed (offers title protection).

B. 02 – Quitclaim Deed (simpler, no title guarantee).

Include all required legal details.

04. Notarize and File the Deed

Sign and notarize the deed.

File with the county recorder’s office and pay any fees.

05. Notify Your Mortgage Company

Understand implications like due-on-sale clauses or refinancing requirements.

06. Update Tax Records

Inform the county assessor’s office of property tax billing under the LLC.

07. Transfer Utilities and Insurance

Update utility accounts and obtain new property insurance under the LLC.

08. Plan for Tax Implications

Consult a tax professional about potential changes (loss of deductions, capital gains, etc.).

09. Update LLC Records

Add the property to your LLC’s operating agreement and asset list.

10. Check Liability Protection

Consult an attorney to ensure LLC liability protections remain intact.

Benefits of transfer

Benefits of Transferring Property from an Individual to an LLC

Transferring ownership of investment property from an individual to a Limited Liability Company (LLC) offers several advantages, including financial protection, legal safeguards, management flexibility, and enhanced privacy.

Financial and Legal Protection

The primary benefit of moving your rental property into an LLC is liability protection. If you own property as an individual and someone files a claim against it, your personal assets could be at risk. By transferring ownership to an LLC, you create a legal separation between your personal finances and the property. This means that any lawsuits or claims are directed at the LLC—not you personally—shielding your personal assets from potential exposure.

Paperwork Required to Form an LLC

To establish an LLC, you’ll need to complete a few key steps. One important document is the Operating Agreement, which serves as the blueprint for your business. While this document is not filed with the state, it outlines how your LLC will operate. You can review templates for guidance, but it’s best to have an attorney or professional service draft your Operating Agreement to ensure compliance with state-specific laws.

The Benefits of Gardening: 101

In real estate, ownership extends to the air above and the ground below your property. This means that anything you plant belongs to you—even after you sell your home—provided it’s addressed in your closing agreement. For example, if you plant a fruit tree, you can retain ownership of its fruit after selling the property, as long as this is disclosed to your realtor or attorney and included in the closing documents. However, be mindful of planting near property lines, as this could lead to disputes, removal of the tree, or sharing profits. Additionally, any fruit that falls to the ground after the sale becomes the new owner’s property. If you build an above-ground garden, you have the right to take it with you since it’s considered personal property, not a permanent fixture. If you leave it behind, it becomes part of the property for the new owner.

Why Buying Fresh Land Is Better When Considering an Irrevocable Trust:

Benefits of Buying Land & Building

• Complete Customization: Design your home to fit your exact needs, from layout to finishes and energy efficiency.

• Modern & Efficient: Enjoy new systems and energy-saving features with fewer immediate repairs.

• Location Flexibility: Choose a site that matches your vision—whether rural privacy or suburban convenience.

• Long-Term Value: Build equity in a home tailored to your specifications, with potential for appreciation.

• Lower Initial Land Cost: Vacant land often costs less upfront than improved lots, with minimal ongoing expenses if undeveloped.

Downsides of Buying Land & Building

• High Upfront Costs: Infrastructure like sewer, power, and driveways can add significant expense before construction begins.

• Time-Consuming & Complex: Managing permits, contractors, and supply chains requires patience and effort, with possible delays.

• Uncertainty & Risk: Unexpected site issues or builder problems can increase costs and timelines.

• Delayed Move-In: Building is a long-term project—you won’t move in right away.

Benefits of a Pre-Built Home

• Immediate Occupancy: Move in as soon as the sale closes.

• Predictable Costs: Clear pricing makes budgeting easier.

• Less Hassle: Skip the complexities of construction—just move in and enjoy.

Downsides of a Pre-Built Home

• Limited Customization: You may need to compromise on layout and features.

• Hidden Issues: Older homes can have costly, unseen problems.

• Higher Maintenance: Expect repairs and upkeep for aging systems and structures.

• Market Competition: In hot markets, existing homes sell quickly, making land a viable alternative.

Benefits of Home Burial

- Personal and Emotional Connection

A private burial site creates a sacred space for remembrance and reflection, allowing family members to visit anytime without restrictions. - Cost Savings

Home burials often cost less than traditional cemetery burials because you avoid purchasing plots and paying ongoing maintenance fees. - Customization and Control

You have full control over the design of the burial site, from landscaping to memorial markers, without the limitations of public cemeteries. - Privacy and Accessibility

Enjoy a peaceful, private setting for memorials and visits, without crowds or time limits. - Legacy and Heritage

A family burial site can become a meaningful part of your property’s history, creating a lasting connection for future generations. - Eco-Friendly Options

Home burials often allow for natural, biodegradable materials, supporting environmentally conscious practices.

⚠️ Important Considerations

- Legal Requirements:

Most states allow home burials, but local laws vary. You may need permits and must follow rules for burial depth, distance from water sources, and property lines. - Health and Safety:

Regulations exist to prevent groundwater contamination and ensure proper handling of remains. - Future Property Implications:

Burials do not automatically make your land a cemetery or exempt it from taxes. If you sell the property later, the burial site may affect its value and use. Look into the benefits of creating a nonprofit when considering an estate and family heirlooms.

Before You Begin

- Check state and local regulations.

- Consult with an attorney or local health department.

- Inform family members and document the burial site for future reference.

Looking for Land Buys, try these.

Disclaimer: This information is for general educational purposes only and does not constitute legal advice. We strongly recommend consulting a qualified attorney for guidance specific to your situation. The details provided are based on publicly available information and are intended to give you a starting point for your own research. Our goal is to provide helpful, transparent, and accurate resources, but professional advice should always be sought before making legal decisions.